Positive interest

Federal funds, then and now

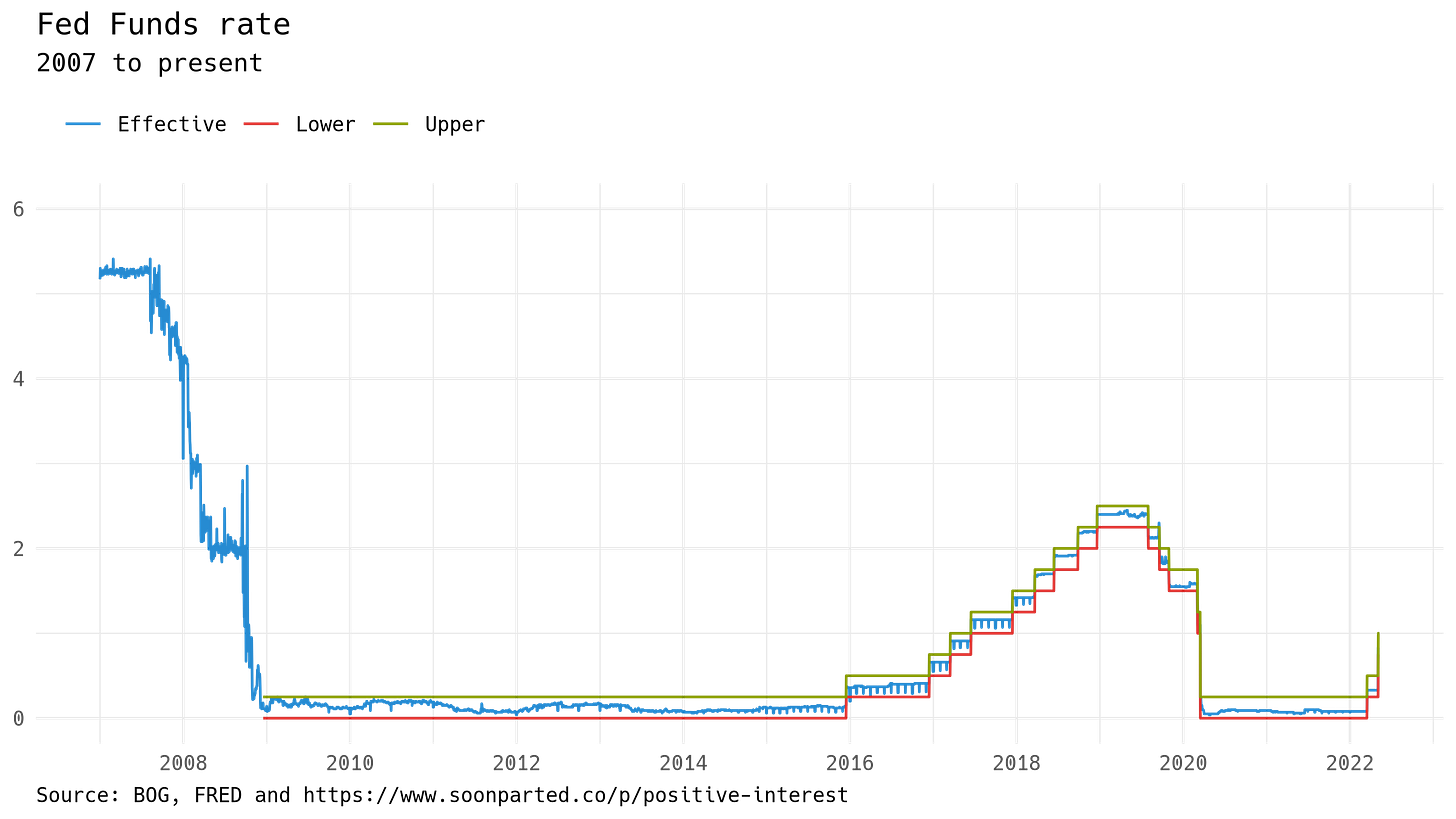

The current turn in monetary policy marks the return of interest at the core of the financial system: for only the second time since the 2008 crisis, the bottom of the target range for the federal funds rate was in March 2022 raised from zero to a positive number, 25 basis points. It was raised again last week, by another half a point. Today, two quick notes on this market.

The federal funds rate is the interest rate on overnight loans of reserve deposits at the Fed. Reduced to zero during the 2008 crisis, it last turned positive in December 2015, reaching two-and-a-quarter percent before the September 2019 repo crunch forced a reversal. The current tightening cycle is off to a much quicker start, with the target expected to surpass the top of the last cycle by the end of this year:

Minsky on the fed funds market

I have some affection for the fed funds market, because it was the subject of one of Minsky’s first publications (QJE 1957). At that time, the market was new, and Minsky had the chance to observe the operations of a money-market broker first-hand. This is the Minsky I often recommend, because it contains early versions of most of his big ideas, free of the macroeconomic camouflage Minsky later put on those same ideas.