Hole in yuan

The People’s Bank of China is buying foreign exchange

There are many interesting facts about China’s foreign exchange reserves, and some of them are even true. It is a fact that the People’s Bank of China rapidly expanded its portfolio of foreign assets up to about 2011. The PBOC then changed FX regimes, and since 2017 the level of reserves reported on its balance sheet has been very nearly constant.

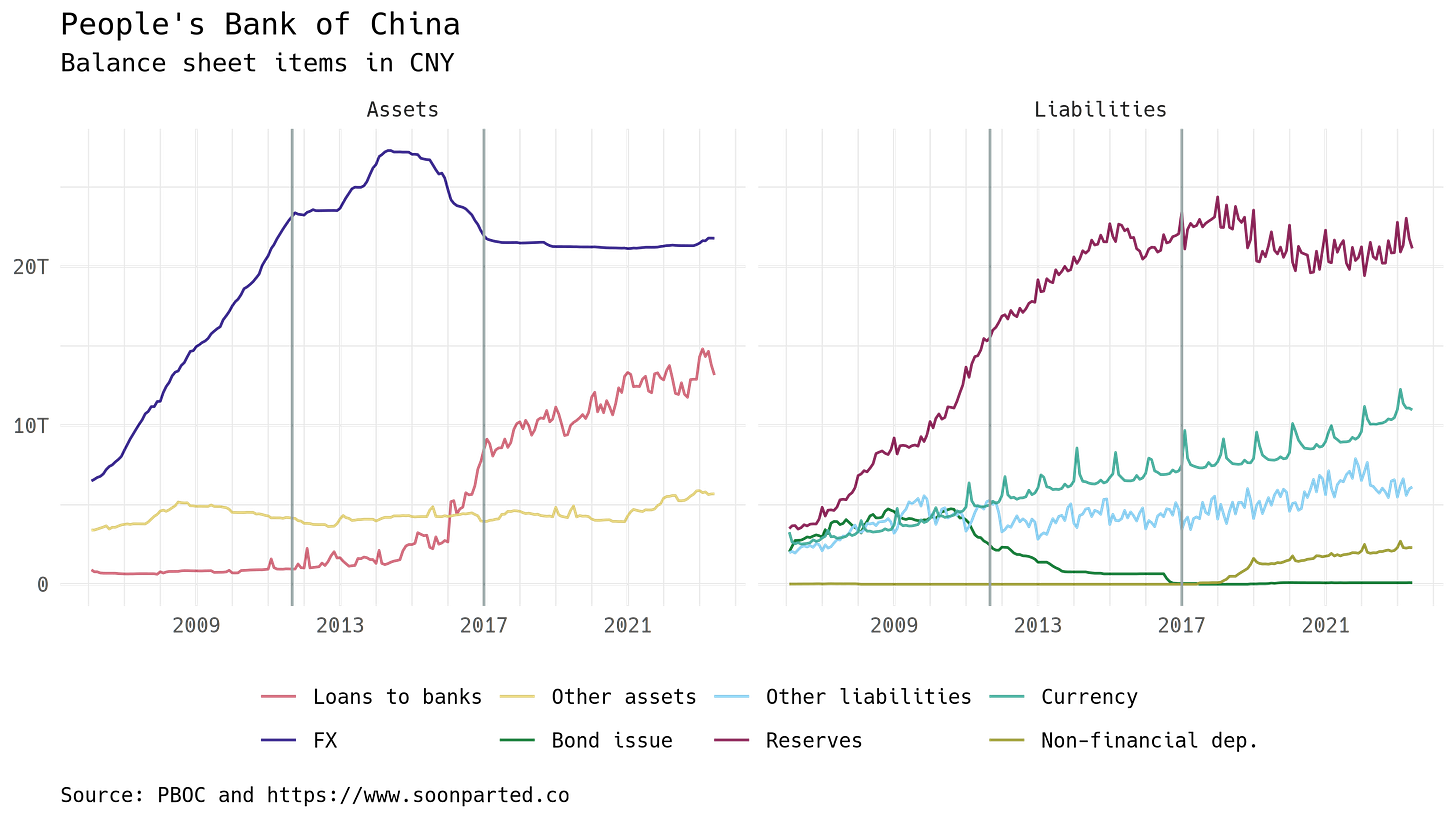

It is notable, then, that in the first half of 2023 the PBOC has been once again buying foreign assets. This graph shows the main components of China’s central bank’s balance sheet:

Assets are in the left panel; liabilities are to the right. The vertical lines mark changes in the PBOC’s approach to managing its balance sheet. The increase I am referring to is the upward step in FX asset holdings in recent months. (Note that the balance sheet is reported in domestic currency (CNY). The same FX portfolio that is reported on the PBOC’s balance sheet is also reported by SAFE, the central bank’s asset manager, in dollar terms.)

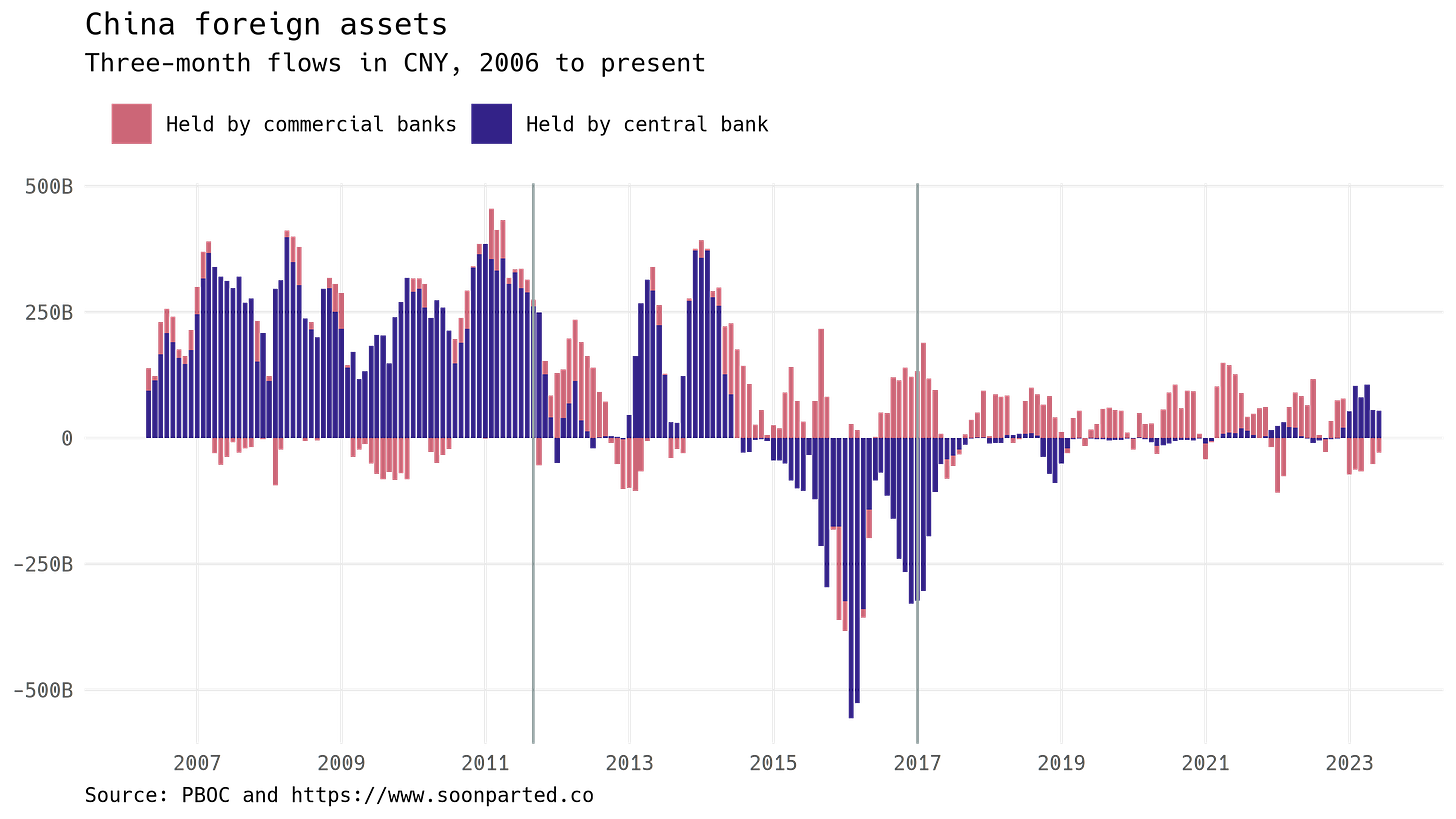

The change appears small relative to the total quantities outstanding, but even so it is a notable deviation from the last several years’ practice. If we view the balance sheet instead in terms of flows, the change appears more significant. This graph shows (in blue) the three-month changes in FX reserve holdings. There are no comparable flows since 2017, and no comparable positive flows since 2014:

The graph also shows flows in foreign assets reported by Chinese commercial banks. Two deductions seem to follow. First, although the PBOC has not been a big buyer of foreign assets since 2017, the commercial banks have to some extent taken its place. And second, the central bank’s recent purchases have to some extent offset sales on the part of the commercial banks.

It seems too soon to say that there has been a change in the FX regime. Perhaps the recent purchases will turn out to be absorption of some of the shocks of adjusting to a positive-interest world. Still, the numbers are big enough to prompt my curiosity. If any readers have context or theories, please send them my way.